Stay in the Know

Get first access to our expert sustainable manufacturing insights.

The latest manufacturing operations insights, trends, and resources to help companies drive efficiency and sustainability in operations.

Glassdome and Siemens are partnering to help manufacturers handle ever-growing carbon compliance and reporting requirements in Europe.

Glassdome Announces Partnership with Siemens SiGREEN and Proof of Concept with LG Electronics Vehicle Solution

Making more money and making the world a better place are often framed as a tradeoff. But a better way to think about it is that production issues and carbon emissions are just different ways to measure inefficiency.

Why Operational Efficiency and Sustainability Aren’t Competing Interests

See how a simple QR code led to deeper data metrics and expedited compliance.

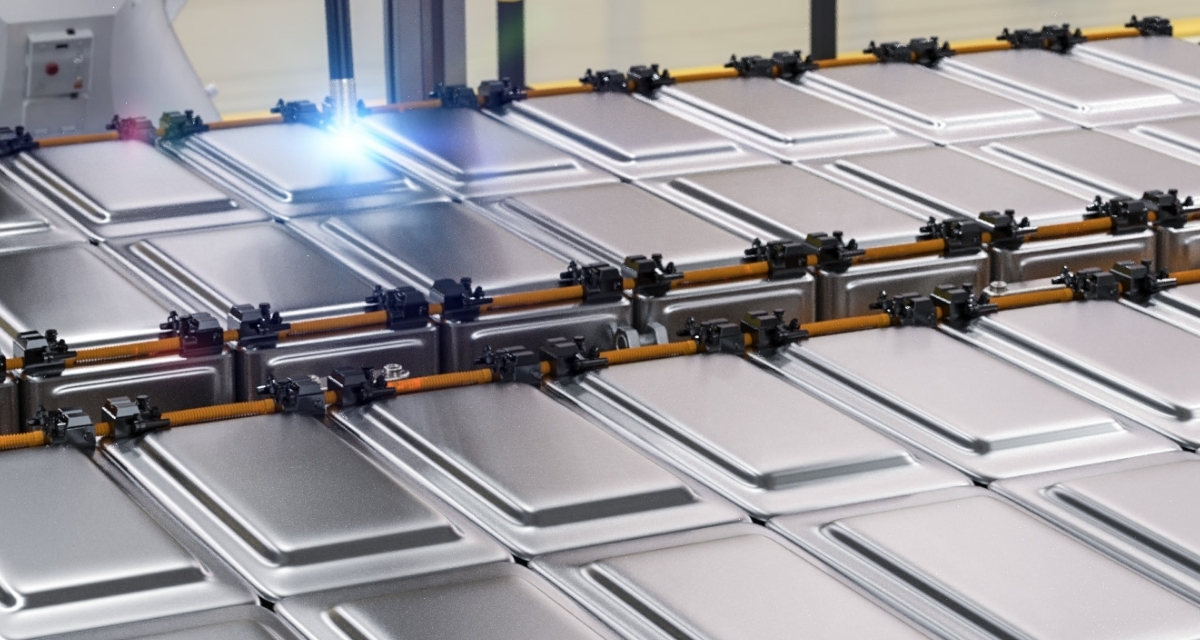

Greater sustainability for battery manufacturers.

Many companies began their sustainability journey with carefully selected numbers designed to make their products look as green as possible. The natural result was a mass backlash against greenwashing and a demand for rigorous standards for sustainability reporting.

LCA vs. EPD vs. PCF: An OverviewGet first access to our expert sustainable manufacturing insights.