The EU Corporate Sustainability Reporting Directive (CSRD): Overview and Timeline

By John Wright

The EU Corporate Sustainability Reporting Directive (CSRD) is a law created by the European Commission that is designed to compel companies to deliver transparent, reliable sustainability reporting to the public.

Voluntary environmental, social, and governance (ESG) reporting has been plagued by inconsistent evaluation and quality that makes it hard for customers to compare companies’ efforts.

CSRD standardizes and regulates ESG reporting, making it easier for buyers to make fully informed decisions. If your company does business in Europe, it’s a rule you need to know.

(Interested in a true apples-to-apples sustainability comparison of products? That’s where product carbon footprint comes in as a metric.)

What is the Corporate Sustainability Reporting Directive (CSRD)?

CSRD is a law that establishes mandatory ESG reporting requirements on top of existing financial reporting. It ensures investors and other stakeholders have a clear picture of the company’s ESG-related impacts, risks, and opportunities.

To comply with CSRD, companies will need to follow the European Sustainability Reporting Standards (see below).

CSRD is built on the EU’s Non-Financial Reporting Directive (NFRD) reporting principles for large companies. The NFRD was focused on financial reporting and gave guidelines on disclosing environmental and social risk management. However, the EU found that NFRD was not comprehensive enough in scope or breadth, and the CSRD supersedes it.

Who is impacted by CSRD?

Around 50,000 companies doing business in the EU will need to comply with CSRD. That more than quadruples the 11,000 companies impacted by the NFRD.

CSRD initially only impacts EU-based companies and subsidiaries with more than 500 employees. By 2029, it will impact small-to-medium sized EU businesses and subsidiaries of foreign businesses listed on the EU market.

What is the CSRD timeline?

The CSRD is being phased in from 2024 to 2029. In 2024 it only mandated calculating and reporting ESG metrics by EU-based companies and subsidiaries. Over the next four years it will grow to extend to more organizations.

Companies in the initial scope for CSRD must have begun collecting data in 2024 to report in 2025. By 2029, all organizations must be in compliance.

Phase One

2024: Data Collection

2025: Reporting

All companies and subsidiaries already covered by the NFRD

Total assets: €20 million

Net revenue: €40 million

Average # of employees during fiscal year: 500

Phase Two

2025: Data Collection

2026: Reporting

Other larger EU-based subsidiaries of non-EU companies, and all companies listed on the EU-regulated market

Total assets: €20 million

Net revenue: €40 million

Average # of employees during fiscal year: 250

Phase Three

2026: Data Collection

2027: Reporting

EU-based small and medium enterprises (SMEs) and SEM subsidiaries of non-EU-based companies listed on the EU-regulated market

Phase Four

2028: Data Collection

2029: Reporting

Non-EU companies with over €150 million in revenue

Net revenue: €150 million + subsidiary or branch listed on the EU-regulated market

What are the European Sustainability Reporting Standards?

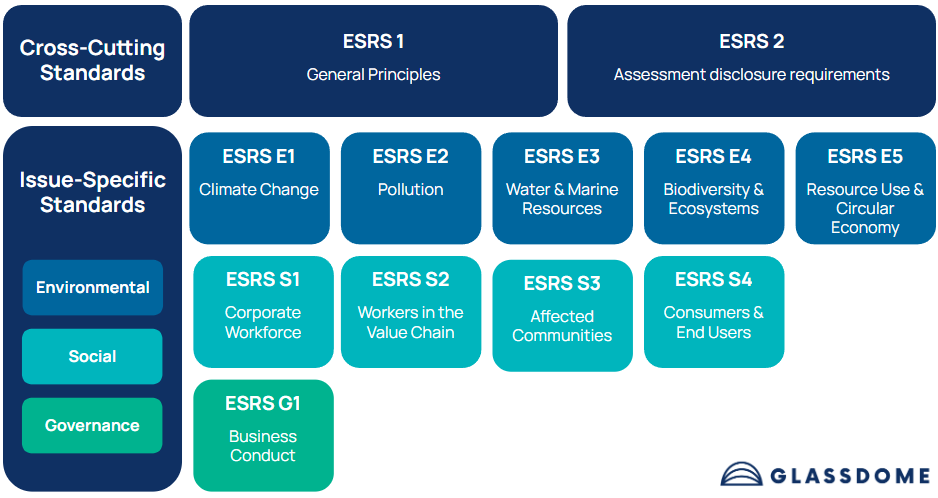

To comply with CSRD, companies need to follow European Sustainability Reporting Standards (ESRS). Two standards cut across all scopes of ESG, and Environmental, Social, and Governance each have their own issue-specific standards. Sector-specific standards are planned but not yet implemented.

ESRS cross-cutting standards

These standards are required for every business covered by CSRD.

ESRS 1 and 2: General disclosure requirements and principles designed to standardize and clarify ESG reporting.

ESRS issue-specific standards

Standard E1 is required for every business. The other standards are only required when the topic is deemed material for the business.

Environmental ESRS E1, E2, E3, E4, and E5: These standards cover climate change, pollution, biodiversity and ecosystems, water and marine resources, and resource use and the circular economy. Standard E1 encompasses greenhouse gas (GHG) emissions, including scope 3. Companies will also need to evaluate their climate risks and report any plans to mitigate and adapt to them.

Social ESRS S1, S2, S3, and S4: These standards cover the company’s workforce, workers in the value chain, affected communities, and consumers and end users.

Governance ESRS G1: This standard covers how the company’s business ethics and conduct

ESRS sector-specific standards

The European Commission is planning to expand the reporting standards to include standards for specific business sectors. Current draft standards include:

- Oil & gas

- Coal, quarries, and mining

- Road transport

- Agriculture, farming, and fisheries

- Motor vehicles

- Energy production and utilities

- Food and beverages

- Textiles, accessories, footwear, and jewelry

Double Materiality Assessment (DMA)

The ESRS mandates that businesses conduct a double materiality assessment to comply with CSRD. Double materiality means the potential impact of each ESG topic on financial and non-financial (people and the environment) measures.

In a DMA, companies need to track and report how their business is impacted by sustainability issues (inward-facing impact), and how their business affects society and the environment (outward-facing impact).

Third-Party Assurance

Just understanding and tracking numbers internally is not enough to comply with CSRD. Companies also need to have a third-party assurance provider verify their data.

Assurance is on a limited basis to start. As CSRD moves towards its full implementation in 2029, companies will need to move to reasonable assurance. That means the third-party assurance provider will provide a comprehensive assessment of their ESG disclosures and operations.

Public Reporting

CSRD demands that the company’s sustainability data is submitted in a standardized digital format to make comparison between companies clear and simple.

What happens if I don’t comply?

France is currently the only country that has integrated the CSRD into its national laws, with associated penalties for non-compliance.

Penalties include fines (up to €18,750) and exclusion from public procurement contracts. Criminal penalties including fines of up to €375,000 and up to five years in prison can happen for not appointing an accredited auditor or obstructing an audit.

As CSRD continues to roll out across EU countries, non-compliant companies can expect to face civil and criminal liabilities, reputational damage, exclusion from public contracts, and investor scrutiny.

How can my company adapt to the CSRD?

At the moment, CSRD is a corporate-level initiative. Carbon accounting software or consulting services firms can handle the needs of many companies in the near future.

However, as regulatory and consumer demand for product-level metrics grows, the need for a true apples-to-apples metric like product carbon footprint grows with it. It’s already crucial for companies that need to respond to the EU’s CBAM regulations.

Companies that prepare early with real data and monthly reporting to demonstrate improvement will have a key head start.

Get a sustainable edge on your competition with real data

Talk to a Glasdome sustainability expert today