The Carbon Border Adjustment Mechanism (CBAM): Overview and Timeline

By John Wright

The European Union Carbon Border Adjustment Mechanism (CBAM) is a regulation designed to prevent carbon leakage by putting a price on carbon emitted during the production of certain carbon-intensive goods when they are imported into the EU.

Carbon leakage is when a good is produced in a country with dirtier, cheaper energy and industrial processes and imported to a place with cleaner, more expensive production, therefore undercutting local products produced using more sustainable methods.

In theory, CBAM should equalize the carbon price of imports and domestic production, keep manufacturing in Europe, and uphold the EU’s climate goals.

In practice, it means a lot of administrative work for companies that import to the EU.

You might be asking yourself a lot of questions: What exactly is CBAM? What companies does it impact? When do I need to start adapting? What happens if I don’t comply? And what should I do right now?

You’ve come to the right place for answers.

What is the Carbon Border Adjustment Mechanism (CBAM)?

CBAM was passed as part of the Fit for 55 in 2030 package of laws designed to cut carbon emissions by 55% by 2030 from 1990’s levels.

The regulation subjects certain imported products to a carbon tax linked to the average auction price of EU Emissions Trading System (ETS) allowances that domestic manufacturers use.

Importers must register with national authorities and buy CBAM certificates. When they declare the embedded carbon emissions in their products, they must pay in the equivalent amount of certificates.

If importers have set up a data collection system that shows they are already paying a carbon price during production above the average values for their country, they can deduct the price from that levy.

Importers don’t only need to collect their own Scope 1 and 2 emissions data. They also need to pay for Scope 3 emissions from their supply chain, which requires a supplier engagement plan if they don’t want to pay for default values.

During the transitional period (until December 31, 2025), importers of CBAM goods must submit quarterly reports that include:

- Quantities of CBAM goods imported during the quarter, specifying country of origin per production site

- Embedded direct and indirect greenhouse gas emissions of those goods

- Carbon price due in the country of origin (if applicable)

Who is impacted by CBAM?

CBAM only applies to certain carbon-intensive product categories. Any companies that produce CBAM goods outside of the EU, even if the company is headquartered in Europe, must comply.

They will also need to provide data if they produce components or materials used in CBAM goods, or sell products to traders who then sell to the EU.

During the transition phase, CBAM applies to:

- Iron and steel

- Cement

- Fertilizer

- Aluminum

- Hydrogen

- Electricity

Any business that imports more than €150 of these products is in CBAM’s scope.

Chemicals and polymers, which include many oil and gas products, are likely to be brought into scope in 2026.

By 2030, CBAM is likely to cover all products under the EU ETS scheme, including:

- Crude petroleum and petroleum products

- Inorganic basic chemicals

- Industrial gases

- Synthetic rubber

- Non-ferrous metals

What is the CBAM timeline?

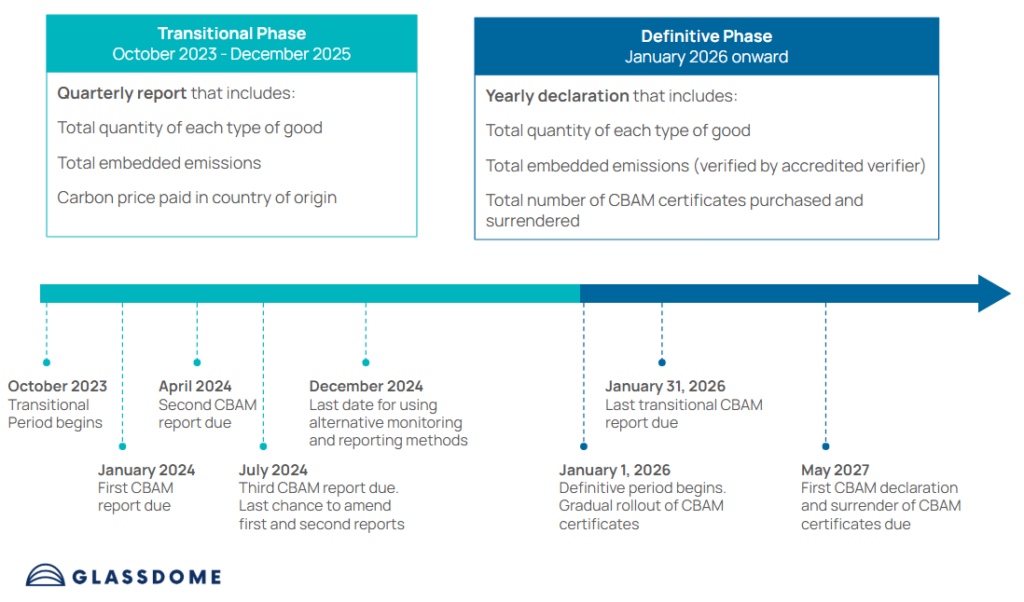

CBAM is split into two phases.

The transitional phase, from October 1, 2023 – December 31, 2025 mandates quarterly reporting, but does not mandate financial adjustments for embedded emissions. It does, however, impose non-compliance penalties. This reporting can use real emissions data or, under certain conditions, default values.

The definitive phase, from January 1, 2026 onwards, begins to require primary data and third-party verification of reports and gradually phases in CBAM financial obligations. By 2034, all embedded emissions in CBAM goods will be in scope.

The combination of primary data acquisition and third-party verification makes the definitive phase a major administrative hurdle, far beyond the admittedly complex spreadsheets of the transitional phase. Importers and exporters will need to find a full-time employee (or team), ongoing consulting services, or a software solution that can adapt to their unique processes.

For a more detailed look, check out the timeline below:

What happens if I don’t comply?

Non-compliance has clearly defined penalties by phase.

In the transitional phase until December 31, 2025, fines will be levied up to €50 per ton of CO2.

In the definitive phase after January 1, 2026, fines will be linked to the weekly average EU ETS carbon price (currently about €85 per ton CO2).

Continued lack of compliance can even result in the company being barred from importing CBAM goods to the EU.

What should my company do to respond to CBAM?

First of all, are you an importer or an exporter?

If you export to the EU, here are five key steps you should take right now to respond to CBAM:

- Determine which products will fall under CBAM, their source, and their volume

- Set up a data collection process (and don’t forget to engage your supply chain)

- Nominate a person or department to be responsible for CBAM compliance

- Collect the real data on quantities of CBAM goods exported to the EU for the quarter

- Combine those volumes with their production sites and supplier emission data (or apply default values), and prepare and submit your report.

If you import CBAM goods, or products made from them, here are your next steps:

- Determine which products and inputs will fall under CBAM, their source, and their volume

- Set up a data collection and supplier engagement process

- Nominate a person or department to be responsible for CBAM compliance

- Collect the real data on quantities of CBAM goods imported for the quarter

- Combine those volumes with their production sites and supplier emission data (or apply default values), and prepare and submit your report.

As you are probably noticing, these steps place an enormous administrative burden on those responsible for compliance, and the risks of non-compliance are high and about to get higher.

That’s where a real-data Product Carbon Footprint platform like Glassdome comes in. Our consultants help you set up a data pipeline directly from your suppliers and processes, and our software solution gives you automated monthly reports to take the paperwork mountain off of your shoulders.

Plus, as the first ISO 14067 verified PCF solution, you’ll know your reports are verification ready, streamlining the process.

Need a partner in the CBAM process?

Set up a time to talk with one of our EU carbon compliance experts.